Vayana Debt Platform (VDP) is a full-stack tokenization infrastructure designed for credit investors and platform providers, including fintechs, banks, NBFIs, family offices, asset managers, hedge funds, and HNIs. Whether you're looking to tokenize your company’s equity, debt instruments, real estate, commodities, or any other real-world assets (RWAs), VDP offers everything you need: legal structure, investor onboarding, compliance tools, secondary trading access, and most importantly – simplicity.

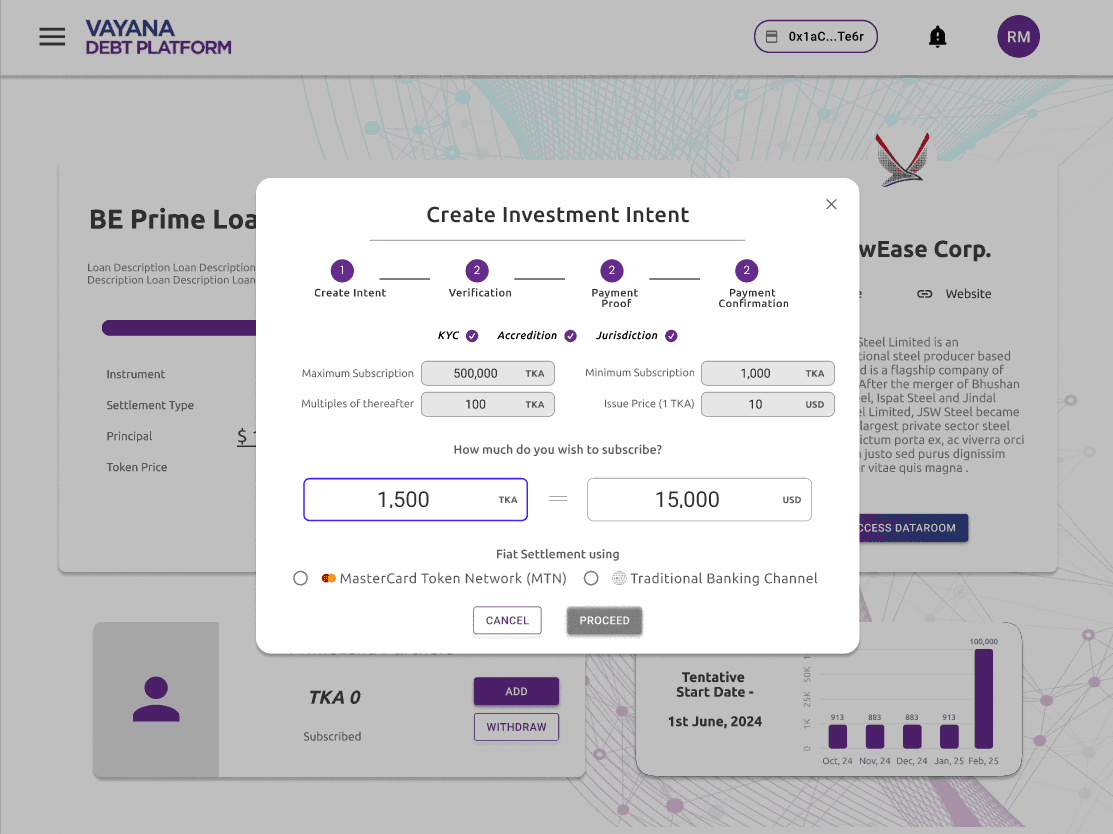

- **Enterprise-Grade Tokenization:** Automate issuance and compliance with built-in KYC and investor eligibility checks.

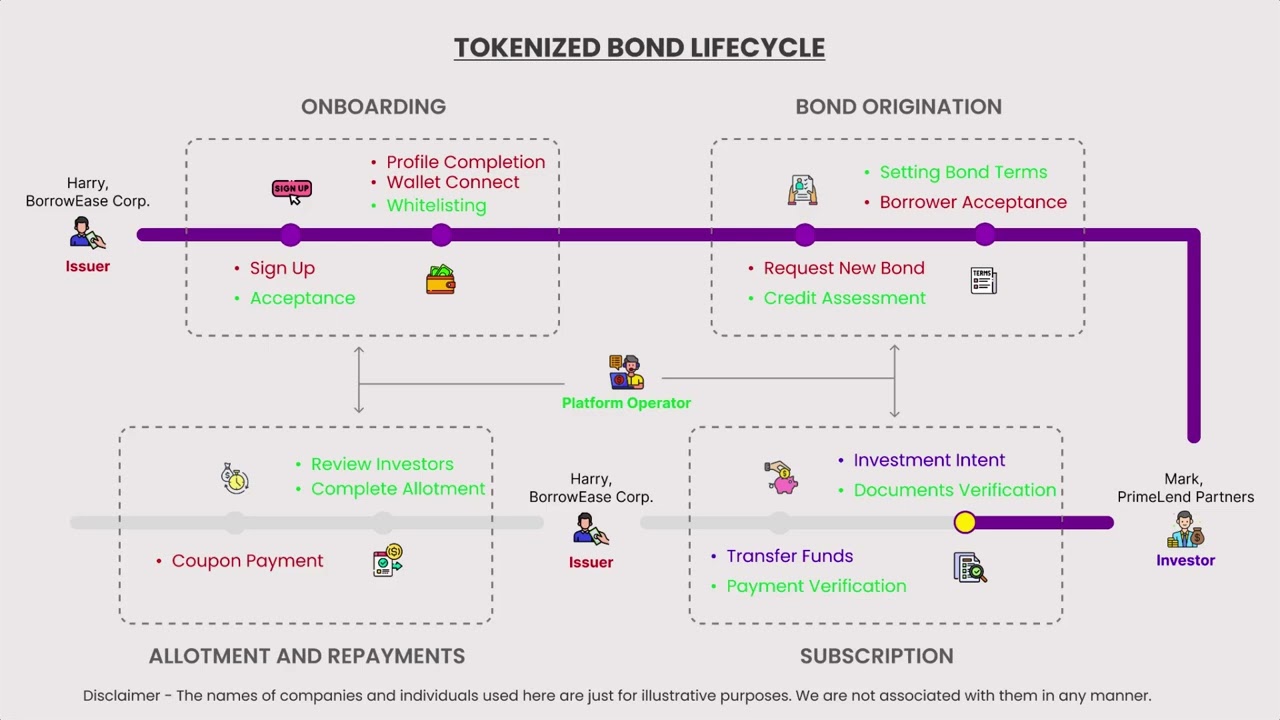

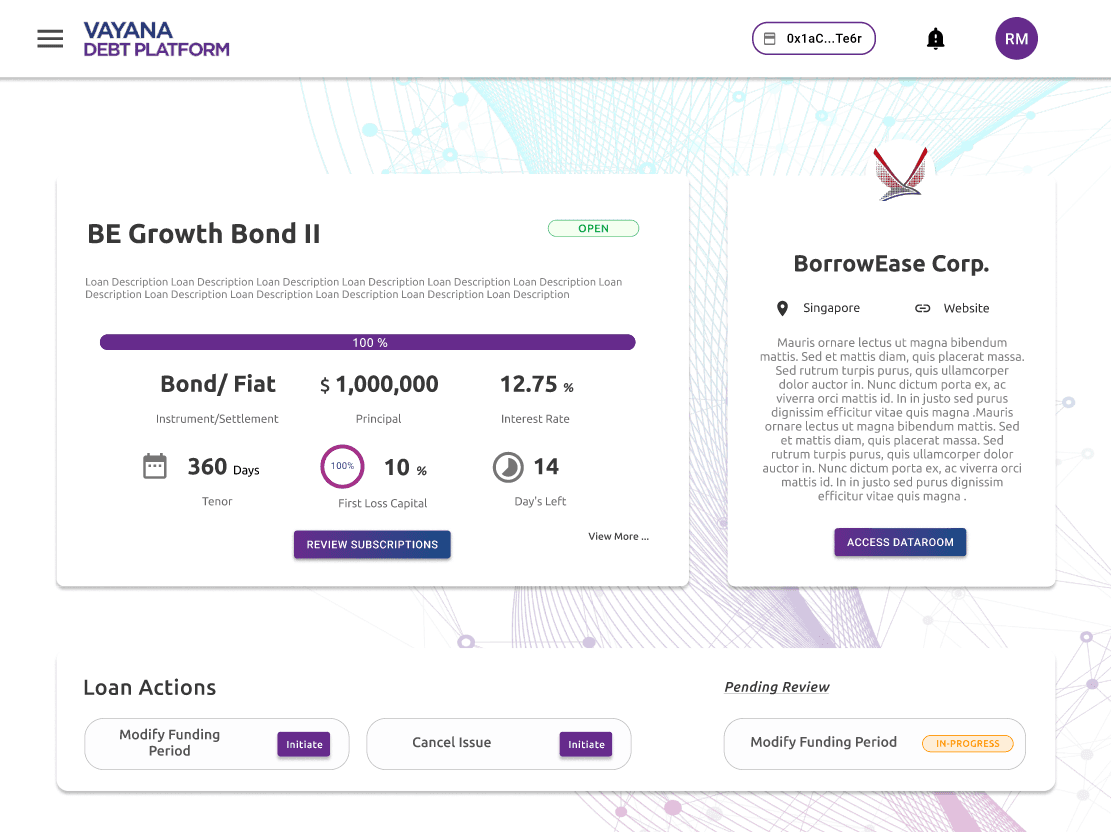

- **Lifecycle Management:** Manage securities across their lifecycle with smart contract-driven actions like minting, burning, and transferring.

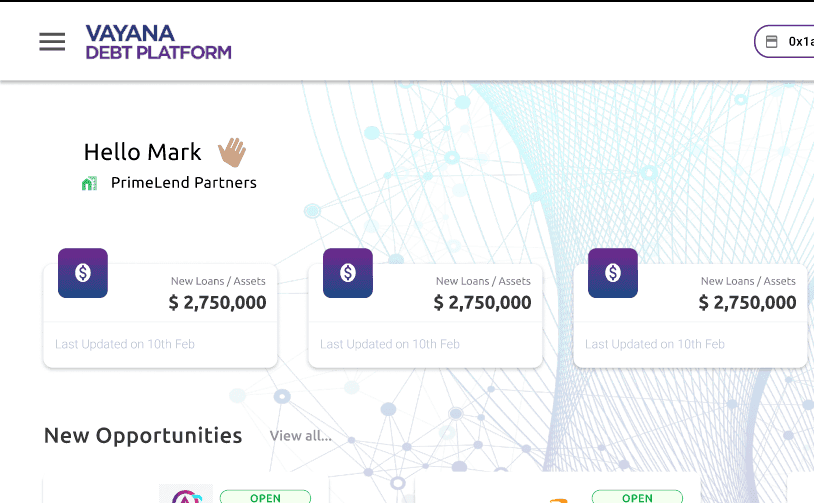

- **Multi-Channel Distribution:** List and sell tokenized instruments across regulated networks and private marketplaces.

The platform is designed for financial institutions, fintech platforms, and asset managers looking to digitize credit workflows and scale investor access. With Vayana, you can attract diverse investor classes, automate compliance, and maintain complete control over your tokenized assets.

- **Enterprise-Grade Tokenization:** Automate issuance and compliance with built-in KYC and investor eligibility checks.

- **Lifecycle Management:** Manage securities across their lifecycle with smart contract-driven actions like minting, burning, and transferring.

- **Multi-Channel Distribution:** List and sell tokenized instruments across regulated networks and private marketplaces.

The platform is designed for financial institutions, fintech platforms, and asset managers looking to digitize credit workflows and scale investor access. With Vayana, you can attract diverse investor classes, automate compliance, and maintain complete control over your tokenized assets.